- This article explains the importance of using payment gateways and provides the best tools to be used.

Card payments have become a prevalent payment method in many types of commerce, especially when it comes to online purchases.

However, making payments within country borders isn’t the same as doing so internationally. While various services will take care of your transactions nationally, the same services might not function as well with cross-border payments.

In this article, we’ll define what cross-border payment gateways are and look at some of the leading available services.

What Are Cross-Border Payment Gateways?

Businesses can use cross-border payment gateways to authorize payments via credit or debit cards in international trade.

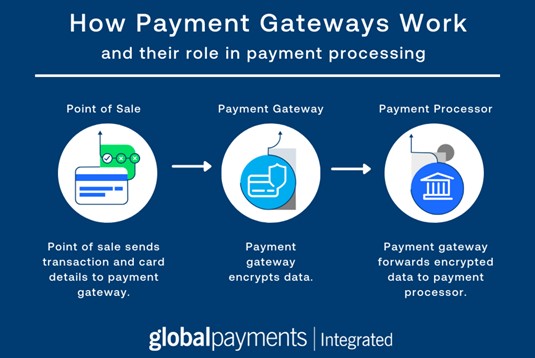

Payment gateways are a crucial part of modern commerce. A company can set up a merchant account and utilize a payment processor, but neither of those tools will be worth much without a gateway.

Cross-border gateways allow businesses to trade in various currencies and different languages. Since they are an essential tool for international business, it would be best to get familiar with the best options available right now.

Source: https://www.pinterest.ph/pin/834995587167303341/

PayPal

PayPal is a familiar name across numerous countries. This service provides a trustworthy solution to online sales and is an excellent choice for a cross-border payment gateway. PayPal is present in more than 200 regions and countries. Furthermore, it supports a decent number of currencies – 25, to be exact.

Authorize.net

Authorize.net is a suitable platform for businesses of every size. This payment gateway functions with all of the most popular cards, such as Visa, American Express, Diner’s Club, and MasterCard. It also features integration for digital payments via PayPal, Visa Checkout, and Apple pay. Authorize.net accepts worldwide transactions, although the business using the service needs to be registered in select Western countries.

Worldpay

This payment processor works directly from websites or apps. Supporting more than 120 currencies, Worldpay is a very handy platform for global trade and, as such, counts among the most popular cross-border payment gateways. One downside of this service is that using it comes with lengthy contracts and mandatory fees for early account termination.

Adyen

Adyen is a platform that can process every payment a business receives while providing risk management and result-tracking tools to the user. This payment gateway works with over 250 methods of payment and deals in 150 currencies. All transactions are subject to a fee and done according to interchange pricing through a merchant bank, where users will need to have an account.

Sage Pay

Sage Pay offers its service in two tiers: one for small and medium companies, and the other for larger businesses. This payment gateway supports 25 currencies and processes international payments via credit and debit cards from every major company.

Stripe

As a payment gateway, Stripe claims to manage transactions worth billions of dollars every year. This platform is intended for big companies with experienced tech teams and requires plenty of customization. Stripe provides its users with various tools and APIs through which a company can design its payment process to the smallest detail. Besides dealing with over 100 currencies, this service supports other payment modalities like one-click checkout and mobile payments.

Amazon Pay

Although its parent company is an industry giant, Amazon Pay is a relatively novel service that’s still making a name for itself. This payment gateway provides cross-border payment options across various currencies and features a user-friendly interface and small transaction fees.

Making the Right Choice

When choosing the best cross-border payment gateway for your business, it would be helpful to take some factors into account. For instance, it’s best to define how much your company can spend for the service, the amount of customer support available, and how the service fits into your payment schedule.

Once you review all those factors, you’ll likely be able to decide between the best cross-border payment gateways presented here.

About the Author

Pamela Wigglesworth, CSP, is an international communication consultant, high-performance presentation coach, speaker, and CEO of Experiential. She helps clients establish their executive presence, structure a clear, concise message, and deliver their thoughts and ideas with style, confidence, and authority.